Important: This site uses New York Close Forex Charts so that each 24-hour session starts and ends at 5 pm EST. These charts are essential for trading price action.

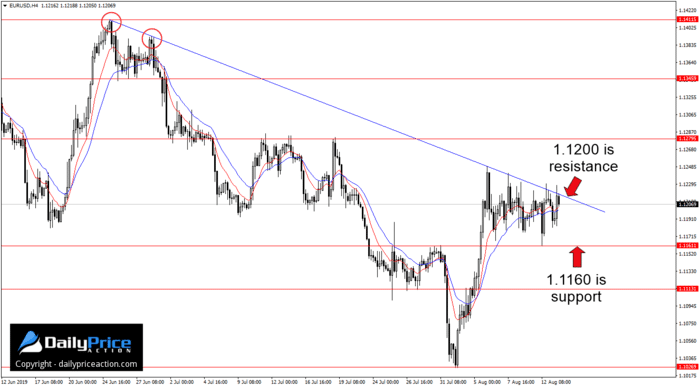

Today marks the sixth straight day of consolidation for EURUSD.

The pair hasn’t made any real progress one way or the other since the 100-pip rally on August 5th.

But as I wrote on Sunday, consolidation doesn’t last forever, and the EURUSD is no exception.

As a general rule, longer periods of consolidation tend to trigger a more aggressive breakout.

One level that could offer clues comes on the 4-hour time frame.

Notice the descending trend line that extends from the late-June swing high.

This level connects with the June 28th highs and has capped every advance starting with the August 8th session.

A close above this level could put an end to the sideways movement of late.

It may also expose the next key resistance area at 1.1280.

Usually, this type of pressure on a resistance area leads to a break higher.

So far, I have no reason to believe that won’t happen here.

But until we see buyers take control as they did on the 5th of August, the EURUSD will continue to be a difficult and even unfavorable pair to trade.

Key support comes in at 1.1160.

If that level fails, we could see EURUSD unwind toward that previous breakout level at 1.1110.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want to see how we’re trading EURUSD?

Click Here to join us and save 40% – Ends August 31st!

[/thrive_custom_box]