Want more price action setups? Join our Exclusive Member’s Community

Today we’re going to start with EURUSD, a pair that has seen a consistent decline for almost seven months now. However that may be about to change.

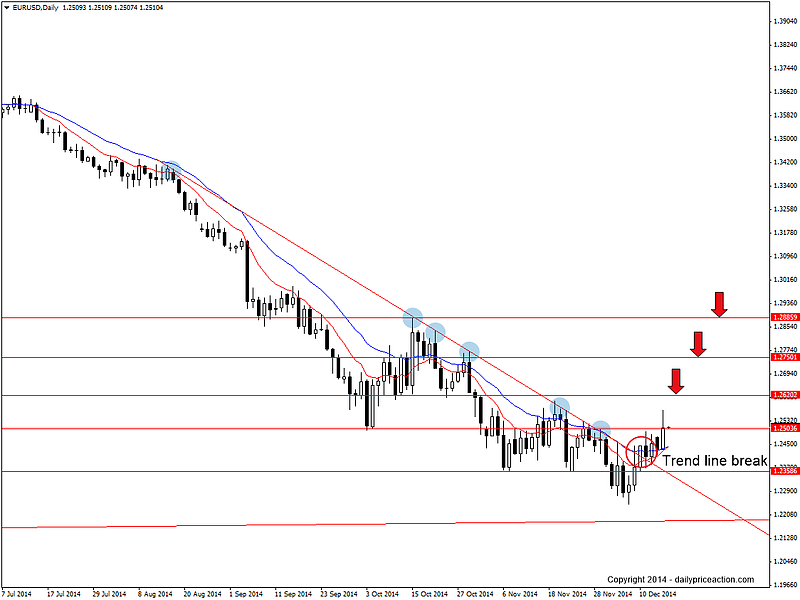

We’ve been tracking trend line resistance from August ever since the market touched it for the fourth time in late October. Since that time the pair has touched this level several more times and recently started to show signs of a possible breakout over the past two weeks.

EURUSD daily chart

In addition to breaking trend line resistance, we may also get a moving average crossover for the first time since July. Although it looks like we’ll need another bullish close tomorrow to achieve a crossover.

Speaking of tomorrow, we have FOMC on tap at 2pm EST, so be sure to trade accordingly knowing that this event is a market mover and EURUSD is guaranteed to be volatile.

Summary: Opportunity to trade this 4 hour bullish pin bar / inside bar. A wide stop is necessary due to tomorrow’s event risk. Targets are marked on the daily chart above. However given the significance of this week’s trend line break, I do think we could see the market back at the 1.2900 area in the coming weeks.

GBPUSD analysis

EURAUD analysis

Want Access to All of the Daily Setups?

Join the Daily Price Action Member’s Community