The next few trading days could determine the EURUSD playbook for the rest of the year.

Discover why in today’s video and get the key levels to watch, as well as my trade plan for July.

The EURUSD is days away from its most significant month-end in years, possibly decades.

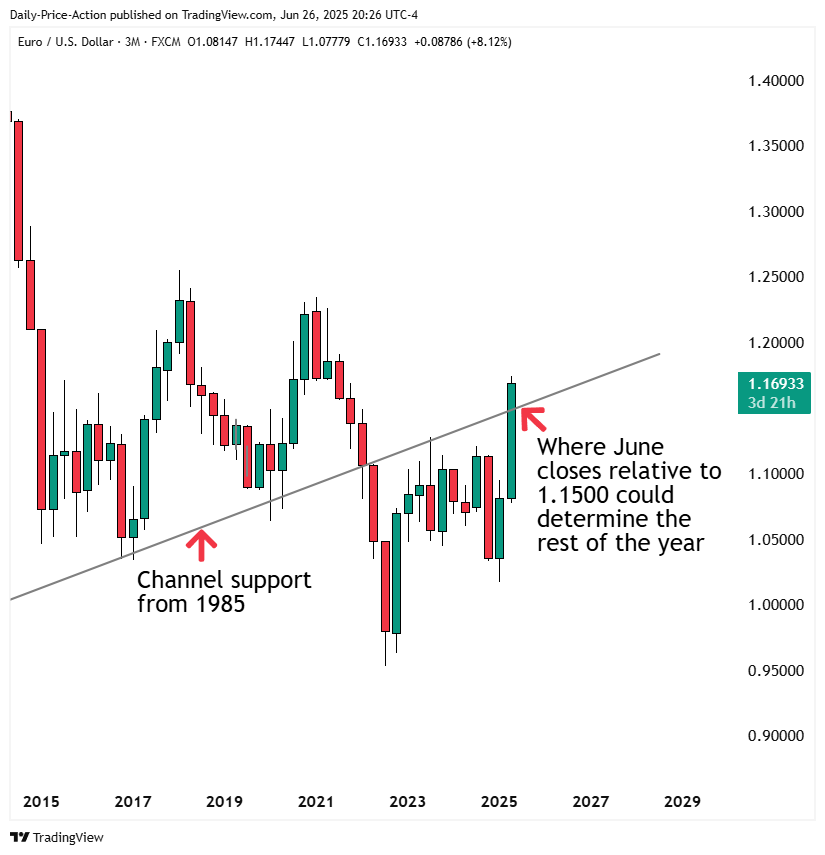

A view of the EURUSD three-month chart from FXCM tells the story. This particular chart uses the pre-euro basket of currencies for data prior to the introduction of the euro.

Remarkably, the EURUSD ascending channel from 1985 is textbook perfect despite the use of pre-euro data.

The euro broke down from this channel in 2022. It even retested the bottom of this channel as new resistance in July 2023. That ended up being a significant high that would send the euro 1,000 pips lower.

Fast forward to 2025, and it’s been a story of higher highs and lows. Pullbacks have been short-lived, and the euro is currently back inside its channel from the 1980s.

A EURUSD monthly and quarterly close above the bottom of this channel at 1.1500 would confirm an incredibly significant reclaim.

However, euro bulls need to hold the line through Monday’s session. That’s the last trading day of June and the second quarter.

The next few trading days could be volatile and even erratic, given the significance of where the EURUSD and DXY are trading.

As noted in previous videos, the DXY 97.70 area is incredibly significant for the dollar. It’s the bottom of the 2011 channel, which is failing so far this week.

So, a EURUSD monthly close above 1.1500 and DXY below 97.70 could ignite these trends in July. I will be a EURUSD buyer on a 1.1500 retest in July if buyers can confirm the bullish reclaim in June.