The EURUSD is starting the week higher after respecting a key support area last week near 1.1170.

If you saw my forecast video on June 20th, you know that 1.1170 was the bottom of an intraday falling wedge pattern.

I discussed the structure in yesterday’s video, as well.

So far, the EURUSD is holding above 1.1230, which is another key level I’ve had my eye on.

But instead of discussing insignificant one or two-day movements, I want to focus on the last six weeks of price action.

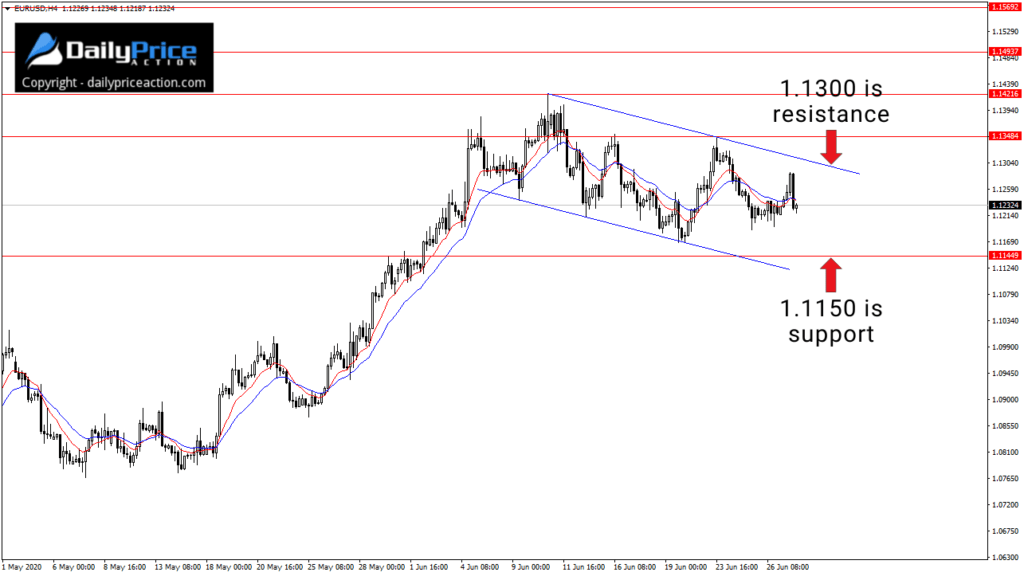

If I take a step back and look at the consolidation that started on June 10th, the EURUSD is carving a descending channel.

I mentioned this in Sunday’s video.

If EURUSD buyers can keep this up, we could see this channel serve as a bull flag to signal a move even higher.

That said, it’s going to depend on what the pair does from here.

As I type this, the EURUSD is threatening to break back below 1.1230.

Furthermore, in order for this new pattern to serve as a bullish continuation pattern, buyers need to take out channel resistance.

At the moment, that level comes in at 1.1300 or just below it.

A close above that 1.1300 area would open the door to 1.1350 and 1.1420.

And as for support, the 1.1150 area is a must-hold level for buyers, in my opinion.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want to watch the EURUSD video I just released in the member’s area?

Get a Lifetime Membership Today and receive exclusive member-only content including one to two new videos every day. Save 40% in June!

[/thrive_custom_box]