[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Important: I use New York close charts so that each 24-hour period closes at 5 pm EST.

Click here to get access to the same charts I use on this website.

[/thrive_custom_box]

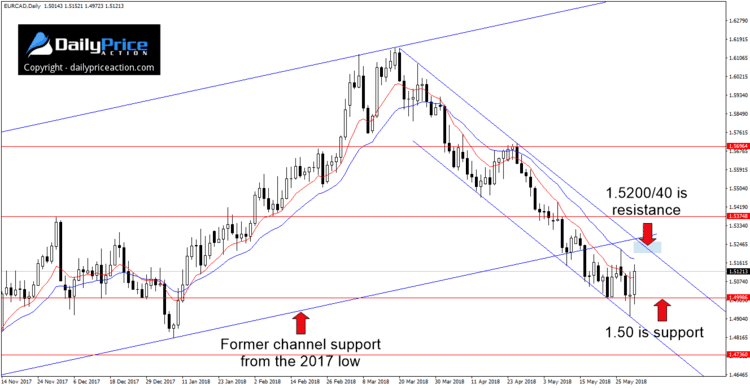

On May 16 I wrote about how the EURCAD had broken below multi-year channel support. The level extends from the 2017 low and had supported prices during the January 2018 swing low and again between the 10th and 11th of May.

In that commentary, I also pointed out a descending channel. The pair was in the process of testing support at 1.5080 and did bounce from the area momentarily.

As you can see from the chart below, even though the EURCAD has continued to drift lower of late, that descending channel support is intact.

Another support level I pointed out in that May 16 commentary was 1.5000. You can see that there were multiple lows at this level between November and December of 2017. It also capped two advances in August of last year.

Since May 23, the EURCAD has caught a bid from the 1.5000 handle. Even yesterday’s session closed back above the level (using a New York close chart) after dropping below it by 80 pips.

Fast forward to today, and we can see that the pair is approaching descending channel resistance. At the moment, I have that area somewhere between 1.5200 and 1.5240. Of course, it depends on how aggressive buyers get over the next few sessions.

Given the May 16 breakdown and the descending channel which is still intact, I’m only interested in selling opportunities. In fact, I’ve been waiting for a retest of descending channel resistance to get short for the past two weeks.

Only a daily close at 5 pm EST above the 1.5200/40 would negate the bearish outlook. However, even then buyers would still need to deal with former ascending channel support near 1.5300.

Key support comes in at 1.5000 followed by 1.4730/40. If the recent price action is any indication and this descending channel remains intact, an eventual retest of the July and September 2017 lows at 1.4470 should not be ruled out.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want to Learn How to Swing Trade?

Click Here to Get The Ultimate Forex Swing Trading Cheat Sheet

[/thrive_custom_box]