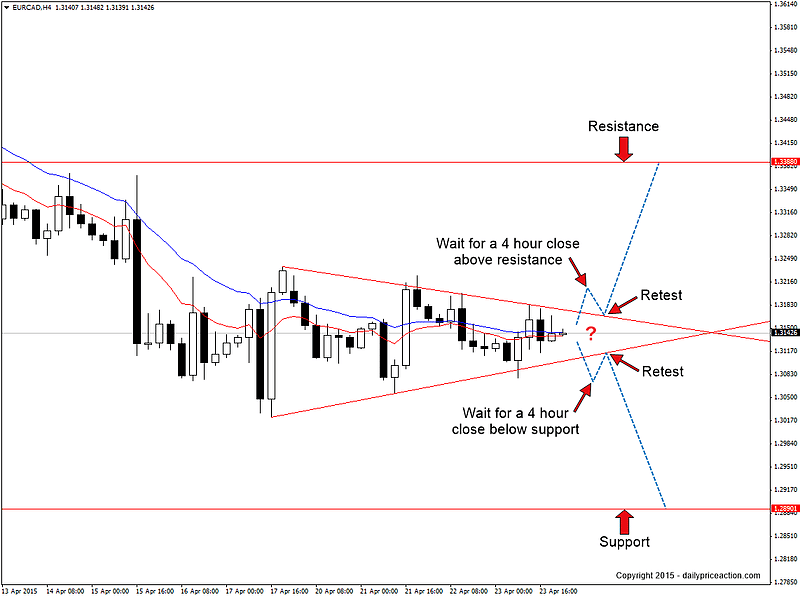

EURCAD looks to be on the verge of an explosive move in anticipation of tomorrow’s events. The wedge pattern is best seen on the 4 hour chart and comes in the wake of a 2,500 pip downtrend that began in March of last year.

A pattern such as this in a strong trend generally indicates a continuation of the preceding trend, however that isn’t always the case. Which is why it’s important that we stay patient and let the market make the first move.

The move I’m referring to would come in the form of a 4 hour close above resistance or a 4 hour close below support. From there we can use a retest of the broken level as our entry signal.

What’s particularly interesting about this pattern is that we have two key levels that line up almost perfectly with the measured objective, which is 215 pips. The 1.3388 resistance level is 218 pips away from the potential breakout area to the upside while the 1.2890 support level is 220 pips away from the potential breakout area to the downside.

Keep in mind that we have major news events for both the Euro and the Canadian dollar tomorrow, so be sure to take that into account as you plan your trade.

Summary: Wait for a 4 hour close above wedge resistance and then watch for a retest of the broken level as new support. Key resistance comes in at 1.3388. Alternatively, a 4 hour close below wedge support would have us watching for a retest of the broken level as new resistance. Key support comes in at 1.2890.

I also noticed it. How about EURAUD wedge pattern below:

Hi Krzysztof,

I prefer the wedge on EURCAD but we’re still waiting for the 4 hour chart to respect either level.

Thanks for your comment.

Cheers,

Justin