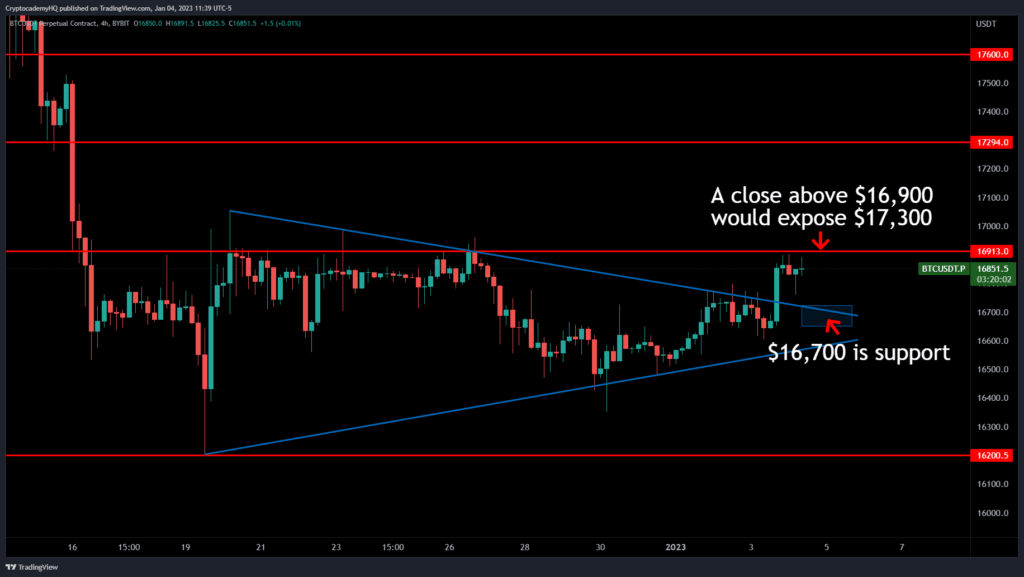

Bitcoin (BTC) broke out overnight from a triangle pattern that has developed since December 20th.

However, today’s Federal Open Market Committee (FOMC) meeting minutes at 2 pm EST promise to bring volatility, so caution is needed.

Furthermore, Bitcoin has yet to clear the $16,900 handle, a resistance level that has held firm for the last two weeks.

So a 4-hour and daily close above $16,900 is required to flip that area to support.

Now, let’s talk about today’s rally during the Asia session.

Asia-session moves in the crypto market tend to get partially, if not entirely, reversed once New York wakes up.

We’re already seeing signs of that today, with Bitcoin retracing 50% of the overnight move so far.

We’ll see if BTC retraces the entire move following today’s FOMC minutes, but either way, the $16,700 region needs to hold as support.

If it doesn’t, and we see Bitcoin close below the December 20th trend line, it would indicate a move back to $16,500 and potentially lower.

On the other hand, if BTC bulls can defend the $16,700 region today and secure a close above $16,900, we could finally see that move toward $17,300 and potentially $17,600.