The markets were fairly quiet today until the RBNZ rate statement which helped to shake things up. There are a few key levels that I’m watching so let’s get to it.

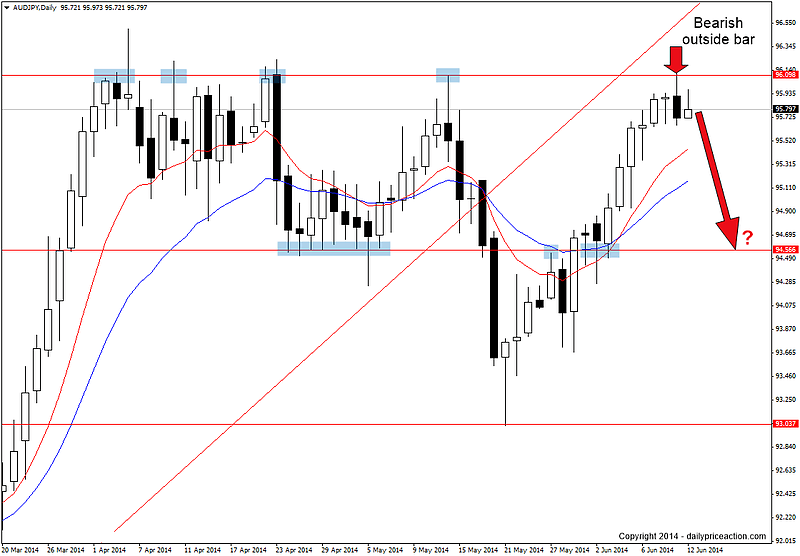

AUDJPY put in a bearish outside bar today. While not something I trade often, outside bars can help us spot changes in trend. The last bearish outside bar at this level on May 14th resulted in a 250 pip drop.

Before getting too excited about a repeat scenario, we have to put things in perspective. The AUDJPY weekly chart at the moment is looking very bullish. Therefore I don’t believe that today’s price action will result in the kind of pullback we saw in May.

Having said that, I won’t be surprised to see the market cool off a little before the next push higher. The next key support level comes in at 94.55, which just so happens to be the 50% retracement from the tail of the bullish pin bar on May 21st. This makes it an ideal level to watch for bullish price action.

As a side note, I have taken a small short position from today’s outside bar. I entered at 50% of today’s move during the spike in price as a result of the RBNZ rate decision. My rational for taking this trade was as follows:

Although not as “conventional” as the usual trades I take, the risk to reward ratio was more than favorable enough to justify the trade. In this case it’s a 4R trade (120 pip target with a 30 pip stop). If price action tomorrow lingers, I should have enough time to get out before any damage is done.

I also realize the AUD event risk scheduled for later this evening. All of this has been factored into the risks associated with the trade.

One last thing, the price action course I’m putting together will have a lot of “live” elements to it including a chat room and a live forum where I’ll be posting charts. This means we’ll be able to chat in real-time about setups like this one as well as intraday setups.

There’s still a lot of work to be done to finish the member’s portal, but I’m extremely excited about launching the course on July 1st. Be sure to sign up here for updates. If you’re already a subscriber to the site no need to sign up again. 🙂

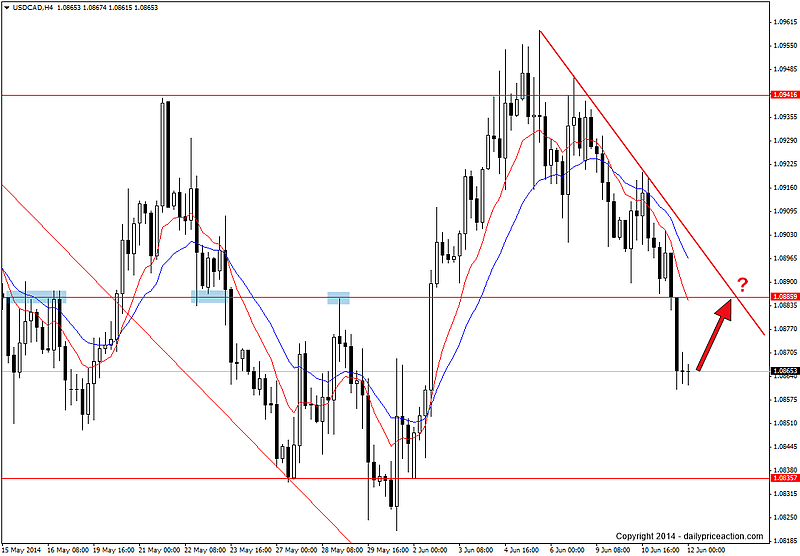

This is the USDCAD level I was previously watching for a buy signal, but today’s price action clearly showed that the market isn’t ready for a rally just yet.

I’ll be watching from the 4 hour chart to see if we get a price action sell signal should the market decide to rally some before the next leg down to 1.083.

I posted about EURAUD yesterday. Today we saw the pair drop 60 pips from where I suggested a sell stop order could have been placed. However with the AUD now looking weaker, I’d expect EURAUD to make a run to the 1.45 area before the downtrend continues.

I tweeted about GBPCHF earlier today noting the pressure that’s being put on the 1.5115 level. A daily close above this level could give way to a larger breakout in the days to come.

Let’s see what tomorrow brings.