Over the last two years, we’ve seen the NZDJPY put in a multi-year top followed by an aggressive 2,000 pip selloff. Some of you may recall the massive head and shoulders that I mentioned on May 6th of 2015, weeks before the pattern confirmed.

However, in the wake of the November 9th U.S. elections, we’ve seen the risk-sensitive pair recoup more than 400 pips. The close above the confluence of resistance at 75.00 on November 2nd was the first sign that sellers were tiring.

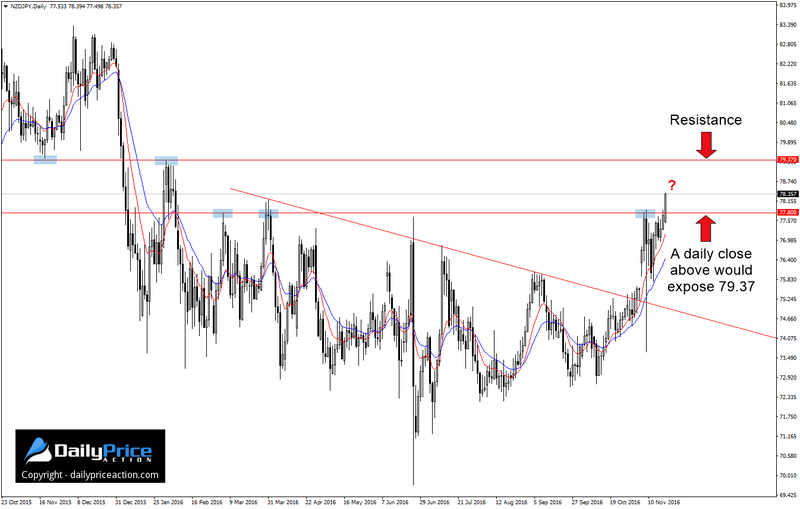

Fast forward to today and the pair is once again testing the key 77.80 handle. This level has played a significant role since September of 2015 and was also responsible for capping the pre-election rally.

But make no mistake, the NZDJPY is still at the mercy of a multi-year downtrend. So while the daily time frame may show a convincing bull move, the weekly chart still casts a bearish shadow.

To be more specific, as long as the July and November 2015 highs at 83.30 hold, my longer-term outlook for the pair remains weighted to the downside. Note that this was also the October 2014 swing low.

From here there are a couple of ways to play this. The first is to watch for a short-term buying opportunity on a daily close above 77.80. Such a break would likely take us to the 79.37 handle.

The second is to wait for a selling opportunity at higher levels. While we won’t know until the pair gets there, the area between 79.37 and 79.80 has the potential to give buyers a run for their money.

You could, of course, opt to do both.

Want to see how we are trading this setup? Click here to get lifetime access.