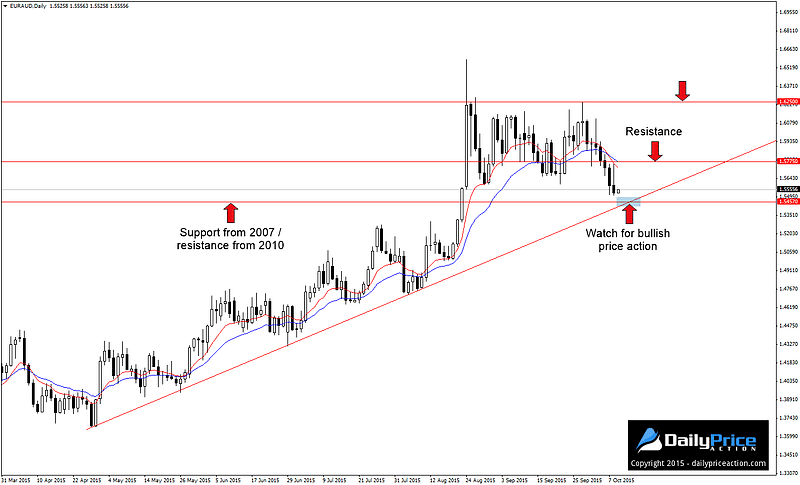

Since finding a bottom at 1.3680 in late April, EURAUD has been in an uptrend that has garnered more than 2,000 pips for the bulls. Of course this move pales in comparison to the massive 9,000 pip selloff that took place between 2009 and 2012.

Still, the rally off of the April low is impressive in its own right. Over the past five months the pair has carved out a well-defined trend line that extends off of the April low. We can use this level to watch for a buying opportunity on what would be a fourth retest of the level since its inception.

It’s worth noting that trend line support intersects with the 1.5457 handle, a level that can be seen acting as support in 2007 and later rejected an attempted rally in 2010.

From here we can watch for bullish price action on a fourth retest of the level. Of course if the bulls fail to deliver and the pair closes below the trend line, it could signal that the uptrend is coming to an end, in which case we can watch for a selling opportunity on a retest of the level as new resistance.

It’s imperative to wait for bullish price action before buying at this level. The recent increase in volatility across the Forex market means that patience and discipline are more important now than they ever were before.

Summary: Watch for bullish price action on a retest of the trend line that extends off of the April low. Key resistance comes in at 1.5775 and 1.6250. Alternatively, a daily close below the trend line would offer an opportunity to watch for bearish price action on a retest of the level as new resistance.