In light of the upcoming RBA statement it’s only fitting that we turn our attention to two Australian dollar pairs that are on the verge of breaking out.

In light of the upcoming RBA statement it’s only fitting that we turn our attention to two Australian dollar pairs that are on the verge of breaking out.

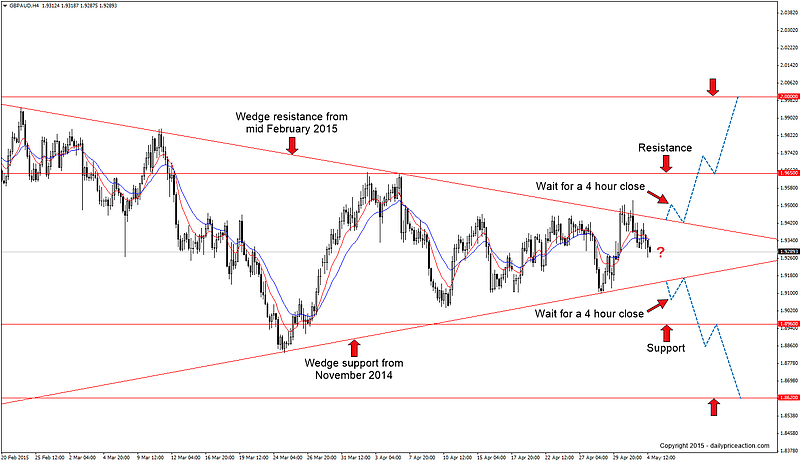

At the moment, GBPAUD is my preferred approach to playing any strength or weakness in the Australian dollar. The pair continues to carve out a wedge pattern that dates back to mid February.

Just last week the bulls attempted to break wedge resistance for the fifth time since inception but the selling pressure proved too strong, keeping the pair contained in the narrow trading range.

On the other side of the wedge we have support that dates back to November of 2014. Of the two levels I would prefer to see a break higher for two reasons.

- The broader bullish trend remains intact

- A break of wedge resistance would provide us with a more precise entry than that of a break of wedge support

Preferences aside, it’s important to remain patient and let the market to make the first move before considering an entry.

Summary: Wait for a break of wedge support or resistance and then watch for a retest of the broken level. Key resistance comes in at 1.9650 and 2.0000 while key support resides at 1.8960 and 1.8620.

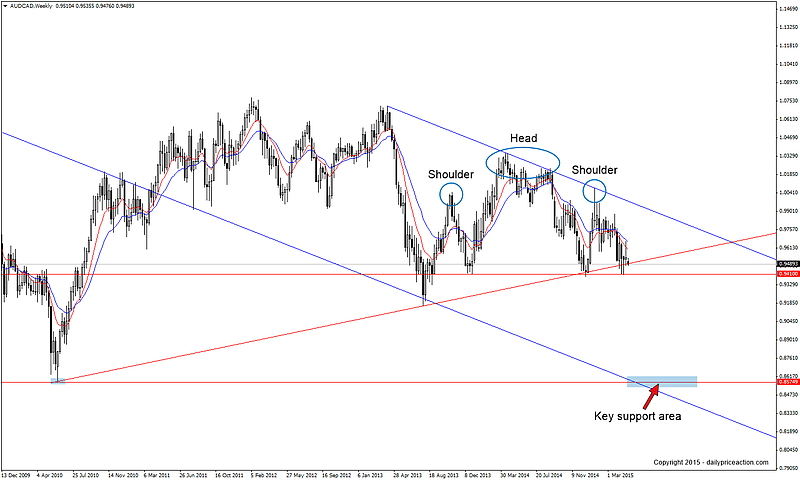

Another pair I’m keeping a close eye on is AUDCAD. I mentioned the pair several weeks ago noting the broader descending channel combined with what looks to be a head and shoulders pattern.

The weekly chart paints the picture.

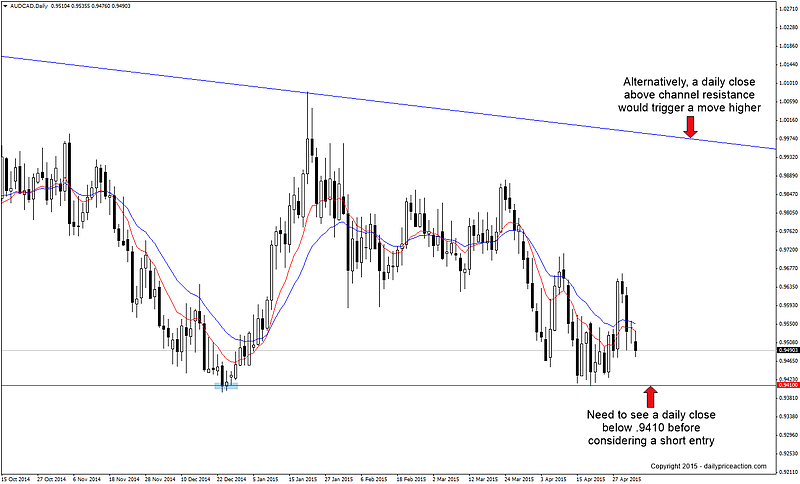

Notice how we have a pattern within a pattern. Of course the head and shoulders is not confirmed until the market offers up a daily close below .9410. Until this happens a move lower is purely speculative.

On the flip side, a break of channel resistance would trigger a move higher. That said, a break of support would present the more favorable opportunity in terms of risk to reward.

Summary: Wait for a daily close below .9410 and then watch for a retest of the level as new resistance. Key support and measured objective comes in at .8575. Alternatively, a break of channel resistance would trigger a move back to 1.0080 and possibly higher.