VET is up 18% since I wrote about the potential for a 40% rally on March 17th.

However, today’s close could determine whether we get a pullback first or if VET bulls can push the market toward my final target.

Today’s video on VeChain covers all of the details.

VeChain (VET) has been a trader’s dream this month. I wrote about the potential for this rally on the 17th, and VET confirmed the breakout two days later.

Since then, VET is up about 18% and is still looking quite bullish.

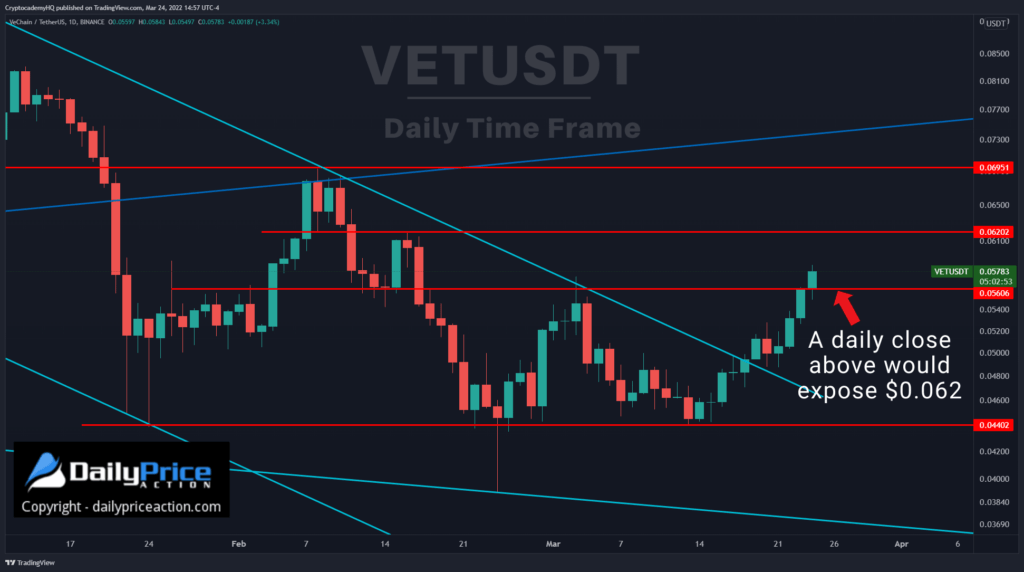

However, today’s session presents a significant test for VET as the $0.056 area has served as a pivot for VeChain since late January.

A daily close (8 pm EST) above that level would flip it back to support. It would also open up the $0.07 resistance area.

I discussed the potential for this entire move on March 17th.

If tested, the $0.07 resistance area will be the most significant test for VeChain bulls since February.

Note that the seven-cent region is the intersection of a key horizontal level and the trend line from late 2018.

Watch the video above for all of the details.

It will take a daily and probably a weekly close above $0.076 sometime in April to reclaim that area. Until then, consider it critical resistance for VET.

Also, the $0.062 level will likely attract a few sellers if tested in the next few days. But above that, skies are clear toward $0.07.

I remain long from the $0.048 region and will likely add to my position following a daily close above $0.056.