[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Important: I use New York close charts. Click Here to Use My Preferred Broker

[/thrive_custom_box]

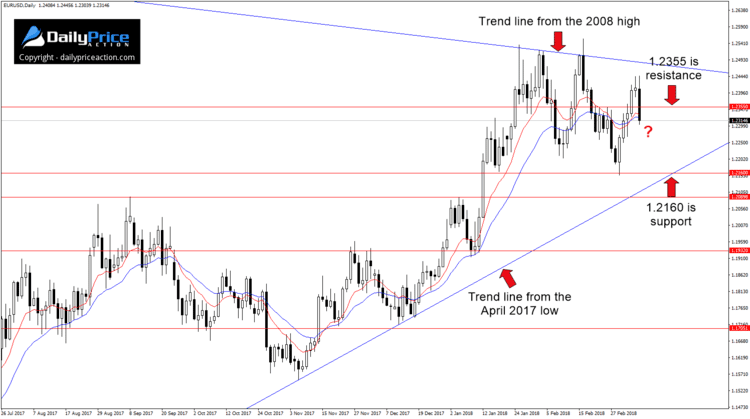

On Monday I wrote that the next move from the EURUSD hinged on 1.2355. This level is the 50% retracement from last week’s range and the location of several session highs between the 21st and 26th of February.

The 1.2355 handle held as resistance during Monday’s session, but Tuesday’s 1.2403 close meant the area should begin to attract bids.

I didn’t start to build a long position here for two reasons. The first is that we never got any bullish price action on a retest of 1.2355 to justify an entry. And the other was today’s ECB rate decision and presser.

I’m glad I held off. While the day is far from over, it seems a sub 1.2355 close is just a formality at this point. That said, today’s final print is a crucial part of the game plan, so waiting to see where the pair lands at 5 pm EST is paramount.

If we do get a daily close (using a New York close chart) below 1.2355, I will consider taking a small short position on a retest of 1.2355 as new resistance.

However, it will be essential to monitor how the pair responds to Friday’s non-farm payroll at 8:30 am EST. Then again, that event alone may be the catalyst needed for the EURUSD to retest 1.2355 briefly before the next leg lower commences.

Just remember that all of the above assumes a sub 1.2355 close today. If buyers manage a daily close above 1.2355, it would suggest that the bullish momentum that began March 1 is intact.

The next key support below 1.2355 comes in at 1.2160. It also appears that the April 2017 trend line will intersect very near the 1.2160 handle, making a retest here much more significant as it relates to the broader trend.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Free Webinar: Learn how I trade pin bars, draw key levels, and much more!

[/thrive_custom_box]